CDMO Services Market for Pharma and Biotech: Growth Outlook and Industry Insights (2024–2034)

This report, published by Towards Healthcare, a sister firm of Precedence Research, provides an in-depth analysis of the global CDMO services market for pharma and biotech. It highlights key growth drivers, emerging trends, and strategic developments shaping the industry from 2024 to 2034.

Ottawa, Oct. 31, 2025 (GLOBE NEWSWIRE) -- The CDMO services market for pharma and biotech is witnessing remarkable growth between 2024 and 2034, fueled by the rising trend of outsourcing among pharmaceutical and biotechnology companies. The increasing demand for comprehensive drug development solutions, enhanced manufacturing efficiency, and regulatory compliance support is propelling market expansion.

Advancements in biologics, personalized medicine, and complex therapeutics are further driving companies to form strategic partnerships with specialized CDMOs. Additionally, emerging economies are playing a vital role by providing cost-effective manufacturing hubs and strengthening healthcare infrastructure.

The adoption of CDMO services is surging as pharma and biotech firms pursue innovative treatment approaches to address evolving disease landscapes. This has led to new collaborations, the establishment of novel CDMOs, and the introduction of advanced products. Moreover, the integration of artificial intelligence within CDMO operations is streamlining workflows and improving efficiency. Collectively, these factors are fostering robust growth in the global CDMO services market.

Explore how leading CDMOs are transforming pharma and biotech manufacturing - get your free sample pages now and see the data behind the USD 176 billion growth story @ https://www.towardshealthcare.com/download-sample/5801

Key Takeaways

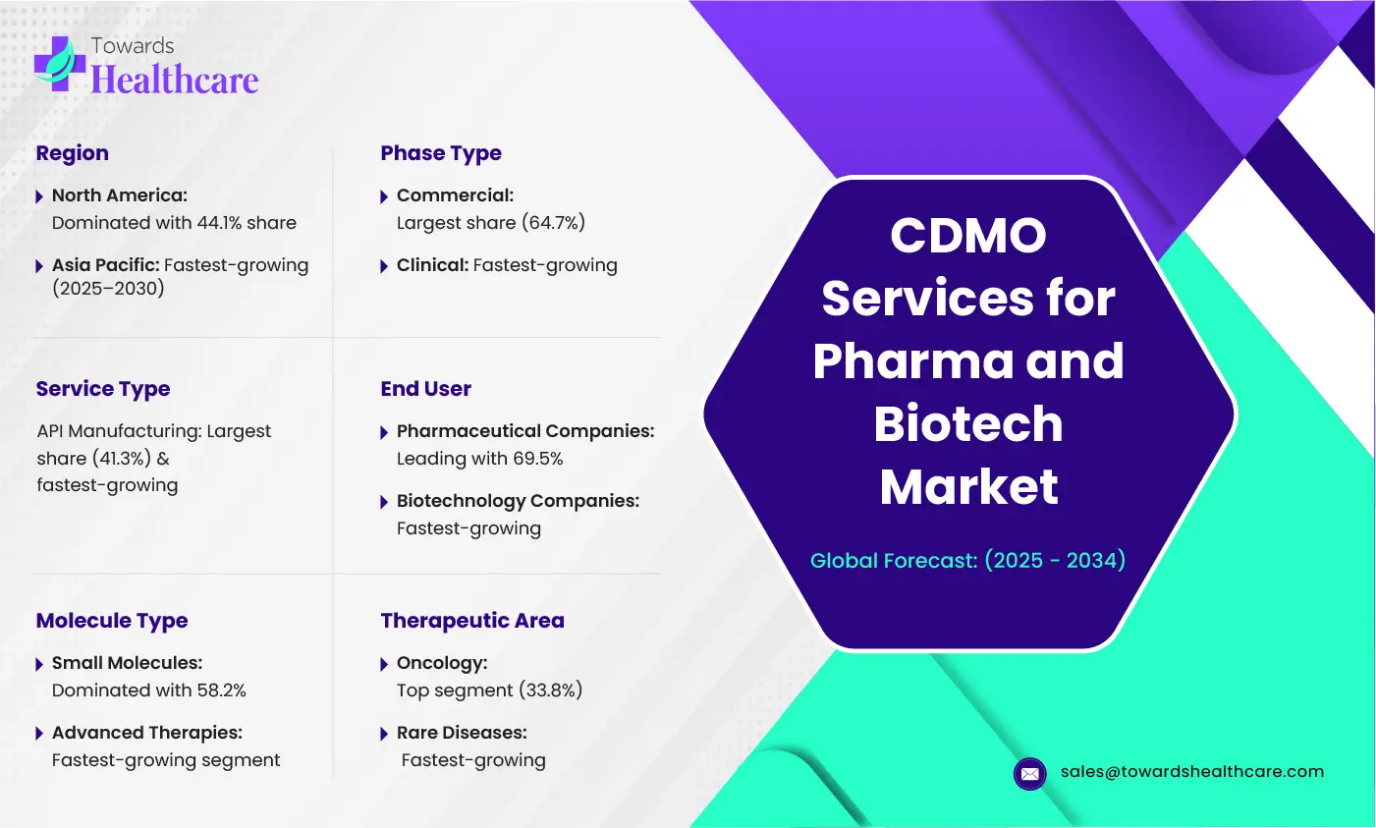

- North America dominated the global CDMO services for pharma and biotech market with 44.1% in 2024.

- Asia Pacific is expected to be the fastest-growing region from 2025 to 2030.

- By service type, the API manufacturing segment dominated the market in 2024 with 41.3% market share and is expected to grow at the fastest CAGR during the forecast period.

- By molecule type, the small molecules segment dominated the market with 58.2% in 2024.

- By molecule type, the advanced therapies segment is expected to be the fastest growing during the forecast period.

- By phase type, the commercial segment dominated the market with 64.7% in 2024.

- By phase type, the clinical segment is expected to be the fastest growing during the forecast period.

- By end user, the pharmaceutical companies segment dominated the global CDMO services for pharma and biotech market with 69.5% in 2024.

- By end user, the biotechnology companies segment is expected to be the fastest growing during the forecast period.

- By therapeutic area type, the oncology segment dominated the market with 33.8% in 2024.

- By therapeutic area type, the rare diseases segment is expected to be the fastest growing during the forecast period.

Market Overview & Potential

The CDMO services for pharma and biotech market encompass third-party organisations that provide comprehensive drug development and manufacturing services to pharmaceutical and biotechnology companies. CDMOs assist from early-stage development (R&D, formulation) to large-scale commercial manufacturing across small-molecule drugs, biologics, vaccines, and advanced therapies (e.g., cell & gene therapies). Moreover, it also provides advanced synthesis techniques and expertise to enhance the production. At the same time, the product quality, tech transfer process, and regulatory compliance are also provided by CDMO, facilitating the entry of the products into the market.

Have questions or need a customized market breakdown? Connect with our industry experts today at sales@towardshealthcare.com

What is the Growth Potential Responsible for The Growth of CDMO Services for Pharma and Biotech Market?

Key drivers for the CDMO services market in pharma and biotech include the desire to reduce costs by converting fixed capital expenditures to variable costs, a need to accelerate drug development timelines, and the increasing complexity of new therapeutic modalities like biologics and cell/gene therapies, which require specialised expertise and infrastructure that many companies lack. CDMOs provide this expertise, handle regulatory burdens, and offer economies of scale, enabling pharmaceutical companies to focus on their core research and development efforts.

What Are the Growing Trends Associated with the CDMO Services for Pharma and Biotech Market?

-

Rise of advanced and specialised therapies:

The growing complexity of new drugs, such as antibody-drug conjugates, oligonucleotides, and cell and gene therapies, is driving demand for CDMOs with highly specialised expertise and technology.

-

Demand for personalised medicine:

The move towards tailored treatments requires flexible manufacturing processes that many CDMOs are developing, often using automation and modular systems to accommodate varying batch sizes and patient-specific needs.

-

Globalisation and supply chain complexity:

Pharmaceutical companies are increasingly relying on CDMOs to navigate complex global supply chains and ensure consistent product quality across different markets.

-

Specialization:

There is a growing trend of CDMOs specialising in specific therapeutic areas or manufacturing processes, allowing them to offer deep expertise in a particular niche.

-

Growth of outsourcing by smaller companies:

Smaller and mid-sized pharmaceutical companies are increasingly using CDMOs to avoid large capital investments in manufacturing facilities, which is a key growth driver for the CDMO market.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What Is the Growing Challenge in the CDMO Services for Pharma and Biotech Market?

Challenges for CDMOs in the pharma and biotech markets include scaling up production while maintaining quality, managing supply chain risks, navigating complex and evolving global regulatory landscapes, protecting intellectual property, and the need for continuous investment in advanced technologies to support new drug modalities like cell and gene therapies. Competition and the pressure to be cost-effective also add to these challenges.

Regional Analysis

How Did North America Dominate the CDMO Services for Pharma and Biotech Market in 2024?

North America dominated the global CDMO services for pharma and biotech market with 44.1% in 2024. CDMO (Contract Development and Manufacturing Organisation) services for North America's pharma and biotech markets include a wide range of support. These services are crucial for companies to focus on innovation while outsourcing the complexities of development and production. Key areas include API (Active Pharmaceutical Ingredient) manufacturing, which dominates the market, and finished dosage form (FDF) development. The biologics sector, especially for cell and gene therapies, is a major growth area, driving significant investment in specialised manufacturing capabilities.

What Made the Asia Pacific Significantly Grow in The CDMO Services for Pharma and Biotech Market In 2024?

Asia Pacific is expected to be the fastest-growing region from 2025 to 2030. CDMO services in the Asia-Pacific pharma and biotech market are booming, with China, India, and South Korea as key players, due to rising demand and cost-effective manufacturing. These organisations provide a range of services, from active pharmaceutical ingredient (API) manufacturing to finished dosage formulations and secondary packaging. Major global players are also expanding their presence in the region to capitalise on its growth, which is also driven by the rise of smaller biotech firms needing specialised manufacturing support.

Uncover how North America leads with 44.1% share while Asia-Pacific emerges as the fastest-growing hub - get exclusive regional insights here @ https://www.towardshealthcare.com/checkout/5801

Segmental Insights

By Service Type,

The API manufacturing segment dominated the market in 2024 with 41.3% market share and is expected to grow at the fastest CAGR during the forecast period. API manufacturing services form the backbone of CDMO operations, providing process development, scale-up, and GMP production for active ingredients. These services ensure consistent product quality and regulatory compliance, enabling pharmaceutical and biotech companies to accelerate timelines. The segment benefits from increasing outsourcing trends as firms focus on cost reduction, flexibility, and global market expansion through specialised CDMO partnerships.

By Molecule Type,

The small molecules segment dominated the market with 58.2% in 2024. Small-molecule CDMO services remain a dominant segment due to their mature technologies and broad therapeutic applications. These CDMOs handle synthesis optimisation, formulation, and large-scale production, ensuring batch consistency and compliance with global regulatory standards. The continued innovation in oral and parenteral dosage forms supports demand from both generic and branded drug manufacturers.

The advanced therapies segment is expected to be the fastest-growing during the forecast period. Advanced therapy CDMOs cater to the growing demand for biologics, gene, and cell therapies that require complex bioprocessing. Their expertise in viral vector production, aseptic manufacturing, and analytical characterisation makes them critical partners for biotechnology firms. Increasing investments in personalised medicine and regenerative therapies further strengthen the adoption of advanced therapy-focused CDMO services.

By Phase Type,

The commercial segment dominated the market with 64.7% in 2024. During the clinical stage, CDMOs offer small-batch manufacturing, formulation development, and analytical testing to support trials from Phase I to III. Their flexible infrastructure allows rapid iteration and regulatory alignment, reducing time to proof-of-concept. Outsourcing in this phase is driven by smaller biotech firms seeking scalable and compliant manufacturing support.

The clinical segment is expected to be the fastest-growing during the forecast period. Commercial-scale CDMO services focus on full-scale manufacturing, packaging, labelling, and long-term supply chain management. These facilities ensure large-volume production under GMP conditions with robust quality systems. As products transition from trials to the market, CDMOs provide continuity, ensuring global product availability and consistent compliance across geographies.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By End User,

The pharmaceutical companies segment dominated the global CDMO services for pharma and biotech market with 69.5% in 2024. Pharmaceutical firms partner with CDMOs to enhance production efficiency, optimise resources, and manage product lifecycles. Outsourcing allows major companies to reduce capital expenditure while accessing specialised facilities and expertise. The collaboration often focuses on scaling commercial production and meeting increasing market demands across therapeutic segments.

The biotechnology companies segment is expected to be the fastest-growing during the forecast period. Biotech companies rely heavily on CDMOs for end-to-end support, from early-stage R&D to GMP production. Limited in-house capacity drives the need for contract partners offering cell line development, process optimisation, and regulatory documentation. This partnership accelerates clinical progress and reduces financial risks during product commercialisation.

By Therapeutic Area Type,

The oncology segment dominated the market with 33.8% in 2024. CDMOs play a crucial role in oncology drug manufacturing, supporting the production of high-potency APIs, antibody-drug conjugates, and complex biologics. Their expertise in containment, cytotoxic handling, and precision formulation ensures safety and quality. The rising demand for targeted therapies continues to drive outsourcing in this segment.

The rare diseases segment is expected to be the fastest-growing during the forecast period. The rare disease segment leverages CDMO partnerships to manage small-batch, highly specialised drug production. CDMOs provide flexible capacity, custom formulation, and regulatory support, enabling faster delivery of niche therapies. The focus on orphan drugs and gene-based treatments further strengthens collaboration between innovators and contract manufacturers.

Browse More Insights of Towards Healthcare:

The oncolytic virus CDMO services market is gaining strong momentum, with revenues expected to climb into several hundred million dollars by the end of the forecast period (2025–2034).

The global AAV vector CDMO services market is valued at USD 1.24 billion in 2024, rising to USD 1.43 billion in 2025, and projected to reach approximately USD 5.14 billion by 2034, growing at a CAGR of 15.24% from 2025 to 2034.

The new chemical entities (NCE) CDMO market is estimated at USD 2.65 billion in 2024, expected to grow to USD 2.95 billion in 2025, and further expand to USD 7.83 billion by 2034, registering a CAGR of 11.44% during the forecast period.

The biotechnology CMO and CDMO market is valued at USD 67.25 billion in 2024, projected to reach USD 74.01 billion in 2025, and soar to nearly USD 199.67 billion by 2034, expanding at a CAGR of 11.54% between 2025 and 2034.

Similarly, the biopharmaceutical CDMO market is calculated at USD 20.55 billion in 2024, rising to USD 22.34 billion in 2025, and anticipated to reach around USD 46.98 billion by 2034, reflecting a CAGR of 8.73% over the forecast period.

The medical device CMO and CDMO market is also set for notable growth, with revenues projected to advance into the hundreds of millions from 2025 to 2034, supported by rising demand for specialized contract manufacturing solutions.

The viral vector-based cell and gene therapy CDMO market is valued at USD 142.77 million in 2024, increasing to USD 162 million in 2025, and is projected to reach around USD 497.7 million by 2034, expanding at a CAGR of 13.44% between 2025 and 2034.

Meanwhile, the U.S. life science market and the global antibiotic CDMO market are both on an upward trajectory, expected to generate revenues in the hundreds of millions by 2034, fueled by technological advancements and evolving manufacturing dynamics.

In parallel, the global bioconjugation market is witnessing exponential growth rising from USD 5.52 billion in 2024 to USD 6.37 billion in 2025, and projected to hit around USD 23.18 billion by 2034, at a CAGR of 15.46% during the forecast period.

Recent Developments

- In June 2025, a collaboration between TAG1 Inc., which is a distributor of clinical quantities of medical isotopes, and PharmaLogic, which is a leading contract development and manufacturing organisation (CDMO) specialised in radiopharmaceuticals, was announced. This collaboration is focusing on enhancing the accessibility and availability of TAG1's proprietary Pb-212 generator platform and alpha isotopes.

- In June 2025, a collaboration between OneSource Speciality Pharma Limited, which is a contract development and manufacturing organisation (CDMO), and Sweden-headquartered biotech company Xbrane Biopharma AB was announced. They will work on the manufacturing of the biosimilar portfolio of Xbrane Biopharma AB.

CDMO Services for Pharma and Biotech Market Key Players List

- Lonza Group AG

- Catalent Inc.

- Thermo Fisher Scientific (Patheon)

- WuXi AppTec

- Samsung Biologics

- Recipharm AB

- Siegfried Holding AG

- Fujifilm Diosynth Biotechnologies

- Boehringer Ingelheim BioXcellence

- Cambrex Corporation

- Jubilant Biosys / Jubilant Pharmova

- Piramal Pharma Solutions

- Curia (formerly AMRI)

- AGC Biologics

- Evonik Industries

- AbbVie Contract Manufacturing

- PCI Pharma Services

- Rentschler Biopharma

- Vetter Pharma

- Emergent BioSolutions

Discover which CDMO giants like Lonza, Catalent, and WuXi AppTec are shaping the global landscape - download the competitive landscape report now @ https://www.towardshealthcare.com/checkout/5801

Segments Covered in The Report

By Service Type

- Drug Development Services

- Pre-formulation & formulation development

- Analytical testing services

- Process development & scale-up

- Regulatory support

- API Manufacturing

- Small Molecule API Manufacturing

- Large Molecule/Biologics API Manufacturing

- Finished Dosage Form (FDF) Manufacturing

- Oral Solid Dosage (Tablets, Capsules)

- Parenterals (Injectables, IVs)

- Topicals

- Others (Inhalation, Suppositories, etc.)

- Fill-Finish Operations

- Aseptic filling

- Lyophilisation services

- Packaging & Labeling

- Primary and secondary packaging

- Serialization & Track & Trace

- Clinical Supply Services

- Clinical trial materials (CTM) management

- Logistics & distribution

By Molecule Type

- Small Molecules

- Large Molecules (Biologics)

- Monoclonal antibodies

- Recombinant proteins

- Advanced Therapies

- Cell therapies

- Gene therapies

- RNA-based therapies

- Vaccines

- Large Molecules (Biologics)

By Phase

- Preclinical

- Clinical

- Phase I

- Phase II

- Phase III

- Commercial

By End User

- Pharmaceutical Companies

- Branded

- Generics

- Biotechnology Companies

- Academic Institutes & Research Organizations

- Virtual Biotech / Startups

By Therapeutic Area

- Oncology

- Infectious Diseases

- Cardiovascular

- Neurology

- Immunology

- Rare Diseases

- Others (Diabetes, Respiratory, Gastrointestinal)

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Stay ahead in the evolving CDMO industry - purchase the full report today and unlock strategic insights driving pharma and biotech innovation from 2024–2034 @ https://www.towardshealthcare.com/checkout/5801

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.